Often, you hear the term NPV whenever the company is purchasing a new item or investing in a new facility. What is Net Present Value?

What is NPV?

NPV (Net Present Value) means the sum of cash inflows and outflows, discounted to their present worth. It is the present value of net cash inflows generated by a project less the initial investment on the project.

In layman’s term, NPV means what is the total worth (regardless savings or cost) in today’s context. For example, what is the equivalent of $1 million in 5 years’ time currently? If we convert the $1 million to today’s time, how much is it worth?

NPV takes into consideration the time value of money. However, there is a catch. It estimates the future cash flows of the project and the estimation may differ from the actual results.

How do you decide on implementing the project?

The rule is simple.

Accept the project if NPV calculated is positive.

Reject the project if NPV is negative.

If there are more than 1 proposal, select the one with the highest NPV value.

Calculations

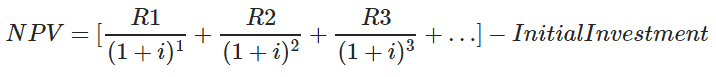

Net Present Value:

i = target rate of return per period,

R1 = net cash inflow during first period,

R2 = net cash inflow during second period,

R3 = net cash inflow during third period,

Example

Question

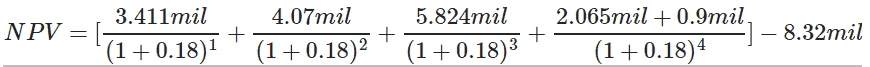

A company decided to invest in a new warehouse and a machine. The total cost was $8,320,000.

The management estimated the cash inflow generated to be $3,411,000, $4,070,000, $5,824,000 and $2,065,000 at the end of the 1st, 2nd, 3rd and 4th year respectively.

At the end of the 4th year, the machine was sold at $900,000.

Assume the discount rate to be 18% per year.

Calculate the NPV.

Answer

NPV = $2,568,000

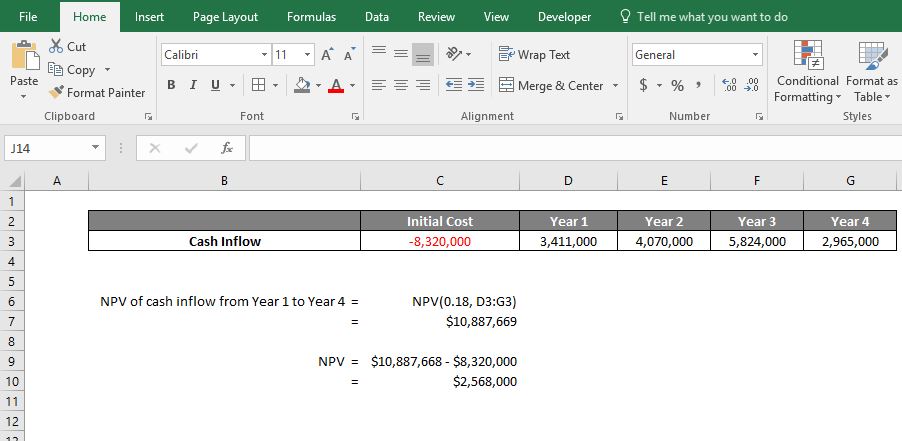

A quicker way will be to make use of the formula that exists in Microsoft Excel.

You just key in the formula: =NPV (rate, values)

Since NPV is positive, it implied that this project was worthwhile to invest.